The EU must use the dollar's weakening to strengthen its own positions - Media.

Europe is seen as a more attractive partner

The Managing Director of the European Stability Mechanism (ESM), Pierre Gramegna, urged the European Union to take advantage of investors' doubts about the US dollar and American government bonds. According to him, markets are closely watching the role of the dollar and view Europe as a more attractive and reliable partner.

Investors have begun to exit the dollar en masse this year due to concerns about US policy and threats to the independence of the Federal Reserve. Gramegna emphasized the importance of Europe working on reforms, such as the establishment of a banking union and a savings and investment union.

The head of the EU Rescue Fund noted that he has no doubts about the status of US dollar bonds as a safe haven, but only conveys thoughts he heard at the IMF meeting in Washington.

Analysis: This news reflects the changing relationship between the US and Europe in the context of economic stability and tensions in financial markets. The disclosure of the ESM leader's views suggests that EU countries are considering alternative investment options due to the dollar's instability. In such a situation, it is important to wisely seize opportunities and enhance one's economic resilience to position Europe as a reliable and attractive investment partner.

Read also

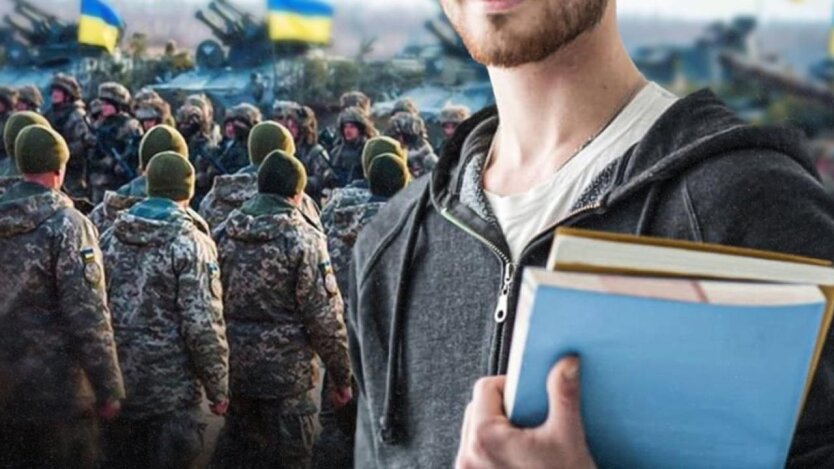

- Military Training in Universities: What Students Will Be Taught

- Apartment for 6000 hryvnias per month: who in Ukraine will receive affordable housing from the state

- Losing the Last Property: Popenko Explained Why People Are Fleeing Ukraine

- Vegetable prices plummeted: what is happening with the cost of potatoes, tomatoes, and cucumbers

- Not only to take out but also to spend: what cash restrictions await Ukrainians in the EU

- Contract and grant at the same time: the Ministry of Education clarified who will be lucky this year